Using Credit

Borrowing money makes it possible to afford things that you couldn’t otherwise, but make sure you understand what you’re signing […]

Read More

Our affordable Credit Booster Loan rates make big changes possible. Take the next step toward financial success by establishing a solid credit score through good habits and consistent, timely payments.

| Product | Term | Interest Rate | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| Credit Booster | 36 Months | 8.000% | Prime Rate: 8.000% | $31.34 |

Credit Booster Minimum $200.00 Max $3,000.00.

Minimum term: 12 months

All rates are subject to change without notice.

All loans are subject to credit approval.

If payment is automatically deducted from a new or existing Country Bank checking or savings account, the rate will be reduced by 0.250 percentage points. New accounts must be opened prior to closing.

Improve your credit score or build credit from scratch each time you make on-time payments.

Reduce your Credit Booster Loan interest rate by 0.250 percent when you set up automatic deduction from your new or existing Country Bank checking account or savings account.

This calculator is for informational purposes only and its use does not guarantee an extension of credit. Your actual term and payment will be provided upon acceptance of a Country Bank Loan.

A good credit score takes you far in life. If you just turned 18, it is time to establish a positive credit score and good financial habits. If you made some mistakes along the way and need to repair and improve your credit score, there is still hope! Both of these situations may be improved with a credit booster loan.

Here’s how it works: Once your Credit Booster Loan is approved, the money is deposited into a Country Bank savings account. A hold is placed on the account for the loan amount which means you can’t access the money. As you make payments on the loan balance, the funds will become available. If all payments are made on time, you will receive an interest credit incentive up to a maximum of $50 at the end of the loan term.

Have peace of mind that this second chance banking option may help you build credit and repair your credit score.

Instead of getting further into debt, it is time to take action and repair your credit score. Country Bank is ready to take this journey with you. Our Credit Booster Loan is a great option that may help you rebuild your credit. It minimizes the risk of further mistakes and creates safe boundaries to help you get your credit score back on track.

It’s important to make the payments on time. We can make this a little easier for you by setting up auto-pay so your payment comes directly out of your account every month when it is due. You just need to be sure you have enough money in your account to make the payment. New accounts must be opened prior to loan closing

Disclosure: If payment is automatically deducted from a Country Bank checking or savings account, the interest rate will be reduced by 0.250 percentage interest points. New accounts must be opened prior to closing.

A good credit score makes a major difference when it comes to living your best life! Building credit is essential for securing loans, mortgages, and even renting an apartment. The better your score, the better rates you’ll receive which all boils down to more savings. Here are five tips to help you build credit effectively:

A Credit Booster Loan may help you establish credit and take steps to repair your credit score. If you are ready to make on-time payments, apply today and take the first step towards a stronger credit score and better future!

Making smart choices with money can make a major difference in your life. Take advantage of these tools and tips to stay one step ahead and secure your financial future.

Borrowing money makes it possible to afford things that you couldn’t otherwise, but make sure you understand what you’re signing […]

Read More

Making payments on a loan with suboptimal terms can make you feel trapped. Luckily, refinancing can help you find more […]

Read More

If you’ve ever financed a car or taken out a mortgage, you’ve likely heard the word “amortization” tossed around. It’s […]

Read MoreYou must be 18 years or older to apply for this loan.

The minimum loan proceeds for a Credit Booster loan is $200.

The maximum loan proceeds for a Credit Booster loan is $3,000.

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS

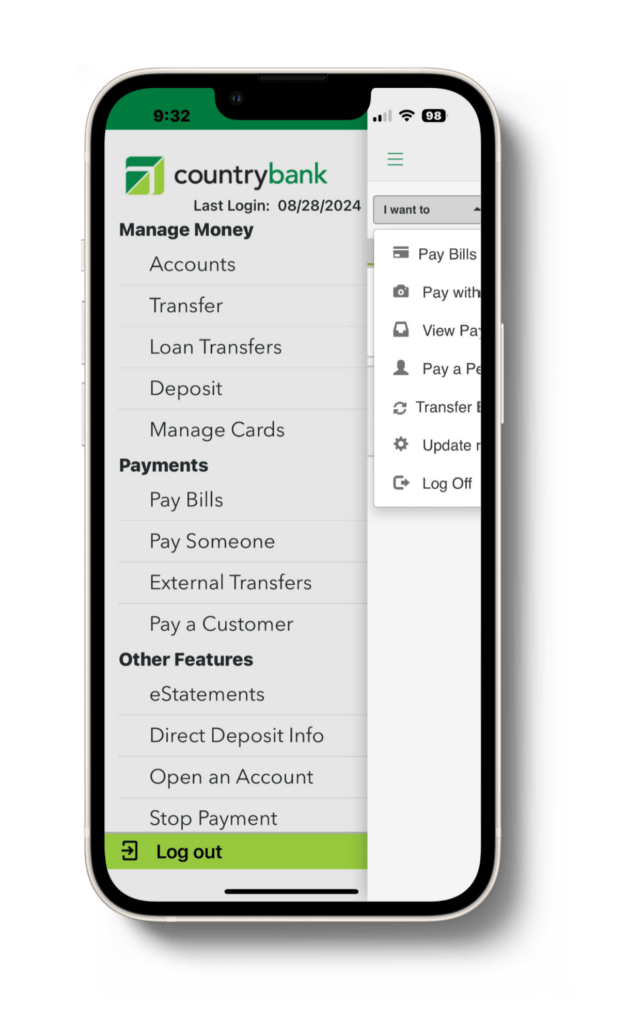

Enjoy the convenience of paying your credit builder loan loan anytime, anywhere.

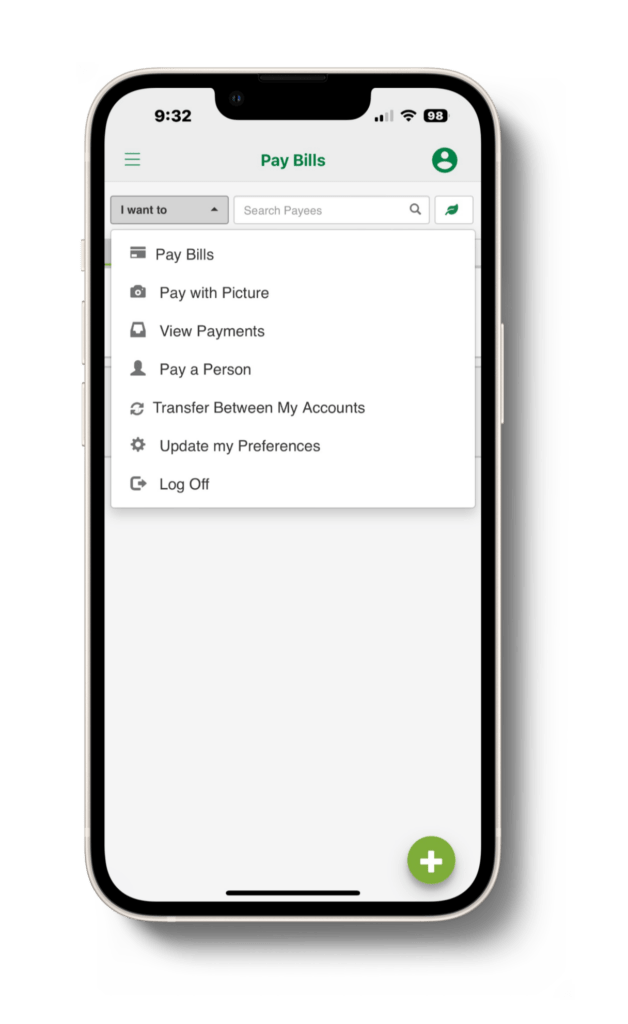

If you are taking advantage of the rate discount by setting up automatic payments from your Country Bank checking account or savings account, keep an eye on your balances to ensure your loan payment goes through. [LINK ACCOUNTS]

Set up custom alerts like low balance warnings and security changes so you are always one step ahead of financial mishaps.