Country Bank, a leading full-service financial institution serving Central and Western Massachusetts, is pleased to announce the appointment of Liz Chrystal as the new Vice President of Project Management. Liz’s appointment represents an important step in the Bank’s continued focus on operational excellence and strategic growth.

“We are thrilled to welcome Liz to the Country Bank team. Her extensive experience across financial services and healthcare, combined with her passion for project leadership and community impact, makes her an excellent fit for this role,” said Miriam Siegel, Chief Culture & Development Officer. “Liz’s strong commitment to innovation with focus on execution while providing superior customer engagement aligns with our Corporate Values of Integrity, Service, Teamwork, Excellence, and Prosperity. We are confident that her skills and leadership will enhance our project management function and capabilities driving our strategic initiatives forward.”

Liz brings over 16 years of project management experience to her role, including the last two years in the financial services industry. She earned her Bachelor of Arts in Liberal Studies with a concentration in Business Administration and Management and holds a Project Management Professional (PMP) certification from Bryant University.

Her career began in project management roles across a variety of sectors, including commercial healthcare and IT professional services for government agencies. She later served on the IT executive leadership team at Baystate Health, a five-site integrated health system headquartered in Springfield, MA. Most recently, Liz was part of the senior leadership team at a financial services company where she led the Enterprise Project Management Office (EPMO), Customer Success, and Business Solutions divisions.

Liz’s dedication to quality and excellence has been recognized throughout her career, including receiving the SHINE Award from Boston Medical Center HealthNet Plan for her work in integrity and quality assurance.

“Joining Country Bank is an exciting opportunity to help shape the future of project management within an organization that values innovation and community,” said Liz Chrystal. “I am eager to contribute to the bank’s continued growth and to support the positive impact it makes throughout the region.”

In addition to her professional contributions, Liz actively supports her local community through regular donations to the Springfield Rescue Mission and the Cupboard Pantry in West Springfield. She resides in Westfield, MA, and is deeply committed to making a difference in Western Massachusetts.

Cash flow can be a significant challenge for small businesses experiencing substantial growth. Without the support of a bank to help bridge the gap between paying employees and receiving payment, things can quickly take a downturn.

Dennis Roberts owns William Roberts Electric (WRE) in Wilbraham, MA. His company has nearly 50 electricians specializing in temperature controls on large-scale projects for commercial clients. Due to the nature of their work, the company typically receives payment 60 to 90 days per invoice, leading to a lot cash flow.

At one point, WRE handled several significant projects, including work for MGM Springfield. Dennis sought a credit line from Country Bank to eliminate the stress of meeting payroll. The process was straightforward: a discussion with his commercial lender, Seth Arvanites, who reviewed the company’s financials and advised on an agreement on the credit line amount and terms. As the company expanded and took on more projects in Boston, his electricians began working overtime to complete expedited projects, leading to unexpected costs. With all these jobs in progress but delayed payments, Dennis used his credit line to support his business needs and reached out again to Seth Arvanites when he needed to increase his credit line.

“Seth came to my office, reviewed my financials, and arranged a quick turnaround with funds being advanced to my business account within a day,” Dennis said. “He was there for me, saying exactly what I needed to hear at the right time. He reassured me, saying, ‘I understand what you’re doing. I understand what you need, and we’re here to help you.'”

Those words left a lasting impression on Dennis. Country Bank provided reassurance when he needed support and helped him realize that he had more than just a banking partnership—he had advocates supporting him. This long-term relationship with the bank has been instrumental in the growth and success of William Roberts Electric.

“[Seth] reassured me, saying, ‘I understand what you’re doing. I understand what you need, and we’re here to help you.'” Dennis Roberts, Owner.

As a small business owner, accessing capital can often seem like a daunting challenge when it comes to growing your business. Fortunately, the U.S. Small Business Administration (SBA) offers loan programs that can provide essential financial support, enabling your business not only to survive but also to thrive. This is intended to guide you through the process of applying for an SBA loan, ensuring that you understand the requirements, benefits, and best practices for securing the funding you need.

Understanding SBA Loans

SBA loans are not provided directly by the government; rather, they are guaranteed by the SBA and issued through approved lenders, such as community banks. This SBA guarantee minimizes the risk for lenders, making it easier for small businesses to qualify for loans. Key benefits include:

- Competitive interest rates: SBA loans typically offer competitive rates.

- Flexible terms: Loan repayment periods can extend up to 25 years for real estate or 10 years for working capital.

- Smaller down payments: SBA loans often require less initial capital, preserving cash flow for your business.

The most popular SBA loan programs include:

- 7(a) Loan Program: Ideal for general business needs, including working capital, equipment purchase, or real estate.

- 504 Loan Program: Designed to purchase fixed assets, such as real estate or machinery, that promote business growth and job creation.

Eligibility Requirements

To qualify for an SBA loan, your business must meet specific criteria:

- Size standards: Your business must fall within the SBA’s size guidelines, which vary by industry.

- For-profit status: SBA loans are intended for for-profit businesses.

- Business location: Your business must operate in the United States or its territories.

- Owner investment: You must demonstrate a personal investment in your business.

- Good credit: A strong credit score and history are essential for approval.

Additional considerations may include:

- A sound business purpose for the loan.

- Evidence of repayment ability.

- Collateral, depending on the loan size and purpose.

Preparing Your Application

What you’ll need handy for the conversation with a Country Bank SBA-approved lender:

- Financial Statements: Include profit-and-loss statements, balance sheets, and cash flow statements for at least the past three years (if applicable)

- Tax Returns: Provide personal and business tax returns to verify income and financial stability.

- Collateral Documentation: List assets you can offer as collateral if required.

Application Process

- Schedule a meeting with a Country Bank SBA-approved lender.

- Prequalification: Meet with your Lender to discuss your needs, eligibility, and loan options.

- Submit Your Application: Provide all required documents, ensuring accuracy and completeness.

- Loan Review: Our Lender will assess your application, and the SBA will review its portion if applicable. This process can take several weeks.

- Approval and Funding: Once approved, our Lender will finalize terms, and funds will be disbursed according to the agreed schedule.

Securing an SBA loan can be critical for reaching your business objectives. By understanding the process, preparing thoroughly, and taking advantage of available resources, you can improve your chances of success. At Country Bank, we are committed to supporting small businesses like yours. Contact us today to discuss your financing needs and start your journey toward growth and success.

Country Bank has been a trusted partner for small businesses for over 175 years. With personalized service, local expertise, and a comprehensive understanding of SBA programs, we are here to help you achieve your financial goals. Contact our Business Banking team or give us a call at 800-322-8233.

Country Bank announced the addition of Lucy Sánchez to its Retail Lending team. She brings nearly two decades of experience in the banking industry and a strong commitment to community engagement.

“We are thrilled to welcome Lucy to the Country Bank team. Her extensive background in banking and mortgage lending, with deep ties to the community and financial literacy, make her an exceptional addition to our retail lending team,” said Miriam Siegel, chief Culture & Development officer. “Lucy’s passion for serving others, along with her entrepreneurial spirit and commitment to building strong customer relationships, aligns perfectly with our corporate values of integrity, service, teamwork, excellence, and prosperity. We are confident that her experience and energy will further strengthen our customer experience and community impact.”

Sánchez began her career in banking in 2006 as a teller and steadily advanced through the ranks to senior leadership roles. Prior to joining Country Bank, she spent more than a decade at Freedom Credit Union, where she was recognized with the prestigious President’s Award: Employee of the Year for her outstanding dedication to both the organization and the community it serves.

A bilingual professional fluent in English and Spanish, Sánchez has long served as a trusted voice within the Latino community. She played an active role on the Latino Initiative Board and became a familiar face through her appearances in local television, radio, and newspaper campaigns. She also authored a financial-education column in Spanish for El Pueblo Latino, covering essential topics such as budgeting, credit, and retirement planning.

Sánchez’s commitment to financial literacy has extended into faith-based and nonprofit spaces. She has led multi-session workshops on financial education for local congregations and has served on the board of the Puerto Rican Cultural Project under the Holyoke Public Library. Her dedication has earned her recognition from Mujeres a la Vanguardia in Springfield for her leadership and community contributions.

In addition to her career in banking, she is a seasoned entrepreneur with experience as a former restaurant owner and the current operator of a sewing academy. Her firsthand understanding of small-business ownership allows her to better support and guide customers in their own financial journeys.

“I’m honored to join Country Bank, an organization that shares my passion for community and financial empowerment,” Sánchez said. “I look forward to helping individuals and families achieve their homeownership goals and build stronger financial futures.”

On Thursday, March 20, 2025 from 5:00-7:00 p.m. in WNE’s University Commons, the FinTech Incubator at Western New England University (WNE) College of Business hosted its second annual Idea Jam, kicking off the second season of its FinTech + AI 413 Startup Launch Series. Designed to foster the growth of local entrepreneurs in the FinTech and AI sectors, the event draws a diverse group of participants from area institutions. Past participants included students from Springfield College, Worcester Polytechnic Institute, The Hartford, and Western New England University.

Participants have the opportunity to pitch their own startup ideas or choose from a list of suggested concepts provided by event organizers. The evening began with an insightful overview of FinTech, featuring discussions on business models of leading startups in the industry, led by WNE Professor Mary Schoonmaker. It was followed by a networking session with experienced mentors and breakout discussions, where participants could refine their ideas with expert guidance.

This year’s series will also mark the beginning of a new partnership between WNE and Country Bank. Country Bank joins MassMutual as a platinum sponsor of the FinTech + AI 413 Startup Launch Series and is the exclusive banking partner of this series. This sponsorship provides financial support and mentorship resources to help aspiring entrepreneurs in the Springfield area turn their ideas into reality.

“At Country Bank, we recognize the importance of innovation in driving economic growth and opportunity in our region,” said Marco Bernasconi, Chief Operating & Innovation Officer of Country Bank. “By supporting this initiative, we are investing in the future of FinTech and AI entrepreneurs who will shape the financial landscape within our region. We are excited to collaborate with WNE to empower these visionaries and help them bring their ideas to life.”

Event organizer WNE Professor Charles Mutigwe expressed enthusiasm for the growing awareness and impact of the program.

“Country Bank’s investment in this initiative is a testament to their commitment to fostering innovation and economic growth in Western Massachusetts,” said Charles Mutigwe, associate professor of Business Analytics and leader of the WNE FinTech Incubator. “With their support, we can expand our efforts to provide the resources that local entrepreneurs need to succeed.”

The Fintech +AI 413 series will continue on April 10, with a Pitch Camp, where mentors will help participants refine and practice their startup elevator pitches. Registration for this event remains open to any student or Massachusetts resident.

“We are excited to see students and professionals come together to explore innovative ideas in FinTech and AI. These events are all about collaboration and creativity, and we look forward to seeing these ideas develop throughout the series,” said Professor Yamini Jha, a professional educator of Business Analytics and a WNE FinTech Incubator faculty member.

Visit the website for more details and registration information for upcoming events in the FinTech + AI 413 Startup Launch Series.

About the FinTech Incubator at WNE

The FinTech Incubator (FTI) at Western New England University’s College of Business is a driving force for innovation, connecting enterprises, entrepreneurs, students, and industry experts with essential resources to advance Artificial Intelligence and FinTech. As a key contributor to the Commonwealth’s growing AI and FinTech ecosystem—particularly in Western Massachusetts—FTI provides access to WNE’s state-of-the-art, high-performance computing facility, the first affordable resource of its kind in the region.

FTI is committed to developing a strong FinTech talent pool by preparing students for careers in the industry while also upskilling the existing workforce. Through hands-on learning, enhanced coursework, and industry collaborations, the incubator serves as a training hub that equips professionals with cutting-edge skills for the next decade of technological transformation. Additionally, FTI fosters a thriving FinTech ecosystem by supporting small and mid-sized businesses, promoting access and inclusion in the marketplace, and driving economic growth through AI-powered solutions. By incubating and launching Massachusetts-based FinTech startups, FTI plays a crucial role in maximizing the economic impact of this rapidly evolving sector. Sponsors of the program include MassMutual, M. Scott Investments and Country Bank.

Throughout history, women have defied expectations, shattered barriers, and made groundbreaking contributions across every field imaginable. From science and aviation to activism and entertainment, these trailblazers have paved the way for future generations, proving that determination and resilience know no bounds.

In this blog, we spotlight just a few remarkable women whose achievements continue to inspire and shape the world today. Their stories serve as powerful reminders of the impact of courage, innovation, and perseverance in the fight for equality and progress.

Greta Thunberg

Greta Thunberg is a Swedish environmental activist who has become one of the most influential voices in the fight against climate change. At just 15 years old, she sparked a global movement with her “Fridays for Future” school strikes, demanding urgent action from world leaders. Thunberg has delivered powerful speeches at the United Nations and other international forums, challenging governments to address the climate crisis. Her unwavering dedication to environmental activism has inspired millions, proving that young voices can drive meaningful change.

Simone Biles

Simone Biles is widely regarded as one of the greatest gymnasts of all time, redefining sport with her unparalleled athleticism and groundbreaking achievements. With 37 Olympic and World Championship medals, she holds the record as the most decorated gymnast in history. Beyond her dominance in gymnastics, Biles has been a strong advocate for mental health, prioritizing her well-being at the 2020 Tokyo Olympics and encouraging athletes to speak openly about their struggles. Her resilience, talent, and advocacy continue to inspire generations.

Lucy Stone

Lucy Stone was a pioneering suffragist and abolitionist who fought for women’s rights and the end of slavery in the 19th century. She was the first woman in Massachusetts to earn a college degree and became a powerful speaker advocating for gender equality. Stone also founded Woman’s Journal; a publication dedicated to advancing women’s suffrage. Unlike many of her contemporaries, she chose to keep her maiden name after marriage, a radical statement of independence at the time. Her lifelong dedication to justice helped pave the way for future generations of women.

Lucille Ball

Lucille Ball was a groundbreaking actress, comedian, and producer who revolutionized the television industry. Best known for her iconic sitcom I Love Lucy, she became the first woman to run a major television studio, Desilu Productions. Ball’s comedic brilliance and business acumen helped shape modern television, paving the way for female creators in Hollywood. Her legacy extends beyond entertainment, inspiring women to break barriers and take control of their creative careers.

Amelia Earhart

Amelia Earhart was a trailblazing aviator who became the first woman to fly solo across the Atlantic Ocean, defying gender norms in aviation. She set numerous flight records and worked tirelessly to encourage women to pursue careers in male-dominated fields. In 1937, Earhart disappeared while attempting to fly around the world, leaving behind a legacy of courage, ambition, and determination. Her pioneering spirit continues to inspire adventurers and trailblazers around the world.

Oprah Winfrey

Oprah Winfrey is a media mogul, philanthropist, and cultural icon whose journey from poverty to global influence is a testament to perseverance and ambition. As the host of The Oprah Winfrey Show, she redefined the talk show format, using her platform to address social issues, empower women, and promote literacy. Winfrey has also made significant contributions to education and humanitarian efforts, funding scholarships and schools for underprivileged students. Her legacy of empowerment and philanthropy continues to inspire people worldwide.

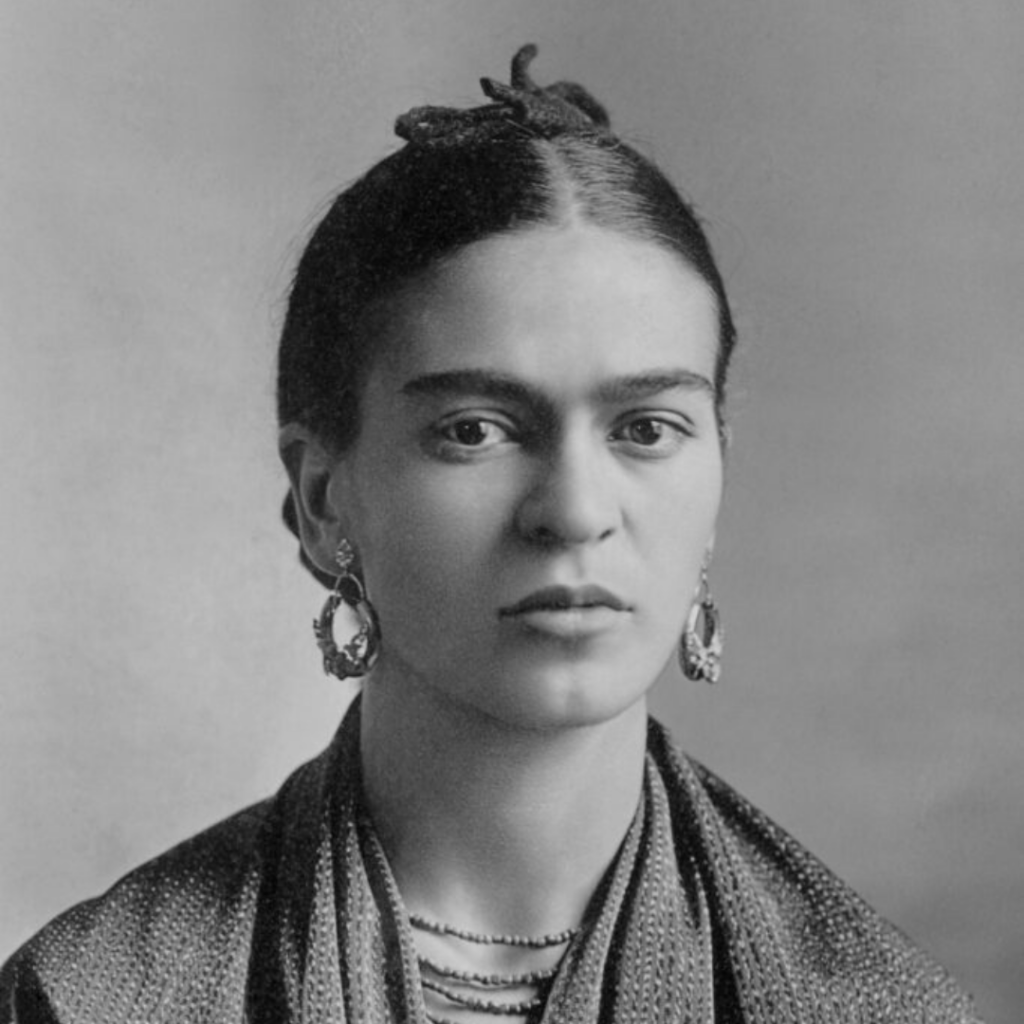

Frida Kahlo

Frida Kahlo was a Mexican painter known for her deeply personal and symbolic self-portraits that explored themes of identity, pain, and resilience. Despite suffering from lifelong health issues due to polio and a severe bus accident, she used art as a form of expression and activism. Kahlo’s work, often infused with surrealist and indigenous influences, has become a symbol of female strength, creativity, and empowerment. Her legacy endures as an inspiration to artists and marginalized communities worldwide.

Alyssa Carson

Alyssa Carson is an aspiring astronaut and space enthusiast who has dedicated her life to the dream of becoming one of the first humans on Mars. She has attended multiple space training programs and became the youngest person to complete NASA’s Passport Program. Carson is a passionate advocate for STEM education, encouraging young women to pursue careers in science and space exploration. Her ambition and dedication serve as an inspiration for the next generation of astronauts and innovators.

Women throughout history have broken barriers, challenged expectations, and paved the way for progress across every field. Their contributions continue to shape our world, inspiring future generations to dream big and defy limits. As we celebrate Women’s History Month, we honor all of the remarkable women throughout history and remain committed to supporting equality, empowerment, and the pursuit of excellence in every community.

In 2016, two local artists and educators founded the Creative Hub Worcester, a nonprofit organization to serve the community’s artists. They envisioned a safe and inclusive space for artists to socialize, take classes, create, show and exhibit their artwork—a nurturing environment that fostered genuine relationships, human connection, and equal access and opportunities for everyone.

That vision is finally coming to fruition, largely due to the relationship they forged with Country Bank, according to Laura Marotta, co-founder and executive director of the Creative Hub Worcester. The bank guided Laura through the acquisition and construction of the former Boys Club facility at 2 Ionic Avenue in Worcester, a historic 1914 building that is being transformed into the Creative Hub Community Arts Center through a partnership with the A&BC and Creative Hub Worcester.

For Laura, everything clicked after meeting with Jessica Royce, SVP of Commercial Banking in Worcester. Jess showed genuine interest in her vision and offered competitive financing terms on the $14 million construction project. “She’s right there when you need anything,” said Laura. “This is my first large real estate development project. I’ve been learning as I go. I can ask them anything.”

It’s crucial for nonprofits to get the respect and funding they need to be able to make a difference in their communities and to keep their communities moving forward, says Laura. She credits Country Bank for supporting and fighting for local organizations such as The Creative Hub.

“I find it amazing that we’re here, and we wouldn’t be here without Country Bank,” she said. “They made this dream happen. They believed in our business plan, and they made it so easy. It’s mutual trust.”

When you’re a family-owned business, a banking relationship makes all the difference. That’s the case with Michael Schaefer, who bought October Company in Easthampton in 1986 and, through that furniture-related business, expanded into the industries of pressure sensitive tape, polyethylene foam, and decorative metal and wood laminates.

Today his combined businesses have sales between $50 to $60 million; the tape business alone grew from $800,000 in 2002 to $30 million currently. Those early years of being a highly leveraged small business were difficult at times. He credits his company’s growth to acquisitions and having a dependable bank.

Michael worked in finance for 22 years before venturing on his own; his former boss used to tell him: “Remember, it’s not the extra eighth of a point that you bargain for but being able to get the money when you need to.”

That advice has served him well. While he had partnered with multiple banks previously, as those banks became acquired, he became increasingly dissatisfied by the lack of care and service. Tom Wolcott, Country Bank’s Chief Commercial Banking Officer, had been his account manager for many years at other banks, and always did a great job for Michael, so when Tom moved to Country Bank, Michael followed.

“Tom has probably been the best banker I’ve dealt with,” Michael said. “We met Ben Leonard SVP Commercial Lending later and he’s also supported us well. They’re responsive and they understand the issues we’re dealing with and the complex structure of our business—and they are able to tailor their solution to our needs.”

Tai Huynh, the company’s Chief Financial Officer, says when there’s an issue or a need, they can get in touch with a decision-maker quickly, which has been essential to the company’s operations.

Also essential to the company is ensuring its success for future generations. Proud of the legacy he has built, Michael has recently been working with Country Bank to help with succession planning as he turns the business over to his children.

“We’re very happy with Country Bank, he said. “They’ve done a great job for us.”

Country Bank proudly marks a historic milestone, 175 years of dedicated service to its communities. Since its founding in 1850, the Bank has grown from a small local institution into a trusted regional financial leader. This remarkable journey has been shaped by the unwavering support of its customers, team members, and communities, reinforcing Country Bank’s commitment to making a meaningful difference in the lives of those it serves.

“Perhaps ‘thank you’ is the most fitting sentiment we can express,” said Mary McGovern, President and CEO of Country Bank. “Each year has contributed to shaping who we are today, and as I reflect on our legacy, I feel immense pride. For 175 years, we have remained steadfast in our commitment to trust, service, and innovation supporting individuals, businesses, and helping to build stronger communities. This achievement is truly a shared success, and we are deeply grateful to all who have placed their trust in us and have been a part of our journey.”

To commemorate this milestone, Country Bank is launching a special anniversary celebration to give back to the communities that have contributed to its success. The “Thank You” campaign will include 175 gifts to community members and initiatives designed to champion local businesses, and non-profits throughout the region.

The campaign will also highlight inspiring customer stories, showcase the Bank’s community contributions, and reaffirm its commitment to excellence. Country Bank invites everyone to join the celebration, share their experiences, and participate in unique giveaways and community events throughout the year, ensuring that this milestone is shared with those who have made it possible.

“As the first female President and CEO of Country Bank, I am honored to lead this celebration of our rich history and enduring commitment to our communities,” added McGovern. “Our legacy of service and innovation has defined us for nearly two centuries, and that same commitment will continue to guide us as we evolve, expand, and enhance the customer experience.”

To learn more visit countrybank.com/175.