REWARDS CHECKING ACCOUNT

GET MORE FROM YOUR CHECKING ACCOUNT AND START EARNING REWARDS TODAY

REWARDS CHECKING ACCOUNT: KASASA CASH BACK CHECKING®

No Monthly Maintenance Fees

You have plenty of things to worry about every day. Fees shouldn’t be one of them.

Cash Back

Earn cash back on your daily debit card purchases with a $10 minimum opening deposit.

ATM Fee Refunds

Receive up to $25 in ATM fee refunds per qualification cycle.

PUT YOUR MONEY TO WORK

INTEREST CHECKING ACCOUNT RATES

You’re always working to improve yourself—your money should too. With a Kasasa Cash Checking account®, you earn competitive interest on your checking balance (no minimum balance required).

Rate Effective Date: February 3, 2026

| Daily checking account balance | interest rate | annual percentage yield (Apy) |

| $0.00 – $20,000.00 | 0.75% | 0.75% |

| $20,0000.01 and up | 0.05% | 0.75% – 0.17% |

| Non-qualifying accounts2 | 0.05% | 0.05% |

INTEREST CHECKING ACCOUNT: KASASA CASH CHECKING®

No Monthly Maintenance Fees

You have plenty of things to worry about every day. Fees shouldn’t be one of them.

ATM Fee Refunds

Receive up to $25 in ATM fee refunds per qualification cycle.*

Low Minimums

Start earning competitive interest on your money with a $10 opening deposit.

ENJOY EXCLUSIVE PERKS WITH EVERY COUNTRY BANK CHECKING ACCOUNT

No Per-Check Charge

Mastercard® Debit Card With eGuard Secure Solution

Digital Banking with Free Bill Pay

Mobile Banking with Free Mobile Deposit

Text Alerts

eStatements

DISCOVER THE BEST CHECKING ACCOUNTS FOR YOUR NEEDS

| Feature | Free Checking Account | kasasa cash back account1 | Kasasa cash account1 | 18/65 Checking Account | Student Checking Account3 |

| Minimum Opening Balance | $10 | $10 | $10 | $10 | $10 |

| Minimum Balance to Earn Interest | N/A | $0 | $0 | N/A | N/A |

| Monthly Fee | $0 | $0 | $0 | $0 | $0 |

| Earns Interest | No | No | Yes | No | No |

| Reduced NSF | No | No | No | Yes | No |

SAFEGUARD YOUR IDENTITY WITH KASASA PROTECT™

Safeguard your identity and finances around the clock with Kasasa Protect. Enjoy affordable, 24/7 credit monitoring, credit report access, credit score tracker, dark web monitoring, lost wallet protection, identity restoration, and alerts for suspicious activity.

BANKING MADE SIMPLE

CHECKING ACCOUNT RESOURCES

Take control of your finances with free checking account tools and resources.

Using Credit

Refinancing Loans

FINDING YOUR SOLUTION

CHECKING ACCOUNT FAQs

How do I read the imaged checks?

Below each check, in larger print, you will find the check number, check amount and the date it was posted to your account. This makes it easier to balance your statement and to reference information.

Can I deposit money into my savings account at any Country Bank ATM/ITM?

Yes, at most of our ATM/ITM locations. The only location that cannot accept deposits is the Worcester Public Market.

DISCLOSURES:

1Kasasa Cash and Cash Back Accounts: Account Qualifications (per qualification cycle): Have at least 12 debit card purchases post and settle; have at least one direct deposit, one automatic ACH transaction post and settle; and be enrolled in and agree to receive eStatements.

If qualifications are met, reimbursements up to $9.99 per transaction, with an aggregate total of $25 for nationwide ATM withdrawal fees incurred on your Kasasa account during the Monthly Qualification Cycle in which you qualified. Please note that ATM fee reimbursements only apply to Kasasa Cash, and Kasasa Cash Back accounts. Kasasa Saver ATM transaction fees are not reimbursed nor refunded. ATM fee reimbursements may be tax reportable, please consult your tax advisor.

The interest rate and annual percentage yield may change after account opening. Fees could reduce the earnings on the account.

2 Interest Rate & Annual Percentage Yield: When Kasasa Cash qualifications are not met during a Monthly Qualification Cycle;

Kasasa Cash Checking: the interest rate paid on the entire balance will be 0.05% with a non- compounding annual percentage yield of 0.05%.

Kasasa, Kasasa Cash Back, Kasasa Cash and Kasasa Saver are trademarks of Kasasa, Ltd., registered in the U.S.A.

3 The primary account owner must be 22 years of age or younger. Minors (under the age of 18) will require a parent or guardian to be a joint owner on the account. When the primary account holder reaches the age of 23, the Student Checking account will automatically convert into a checking account, disclosures will be provided at that time. Please note that rates, fees, and balance requirements may vary based on the account available at that time. Must be 18 or older to open online.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

Contact Us

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.

SKIP THE TRIP

MOBILE BANKING

24/7 Access

Manage your accounts from the palm of your hand whenever it’s convenient for you.

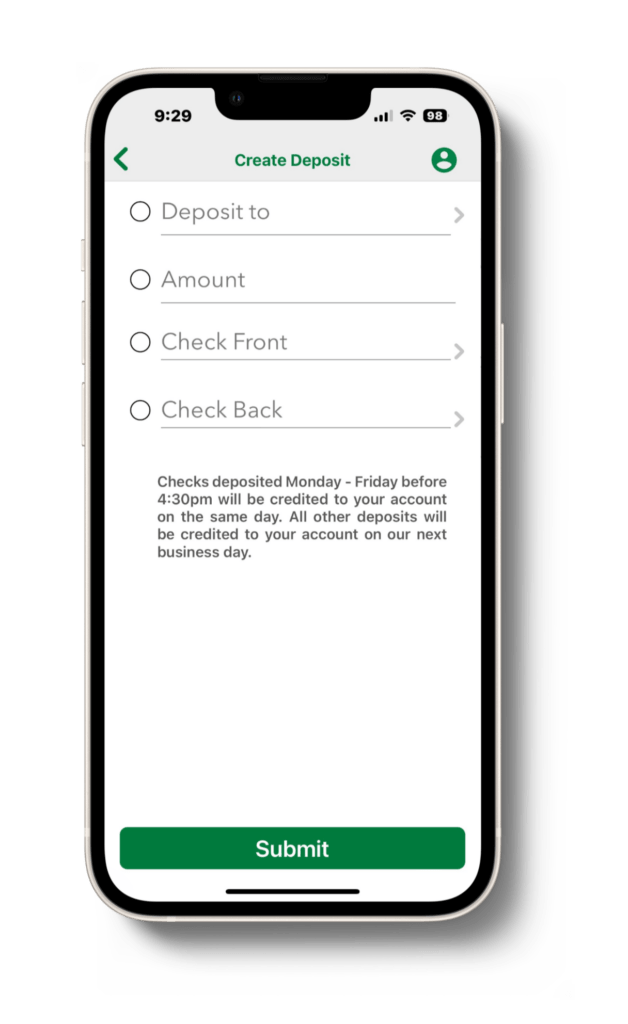

Mobile Deposit

Deposit checks with the snap of a photo.

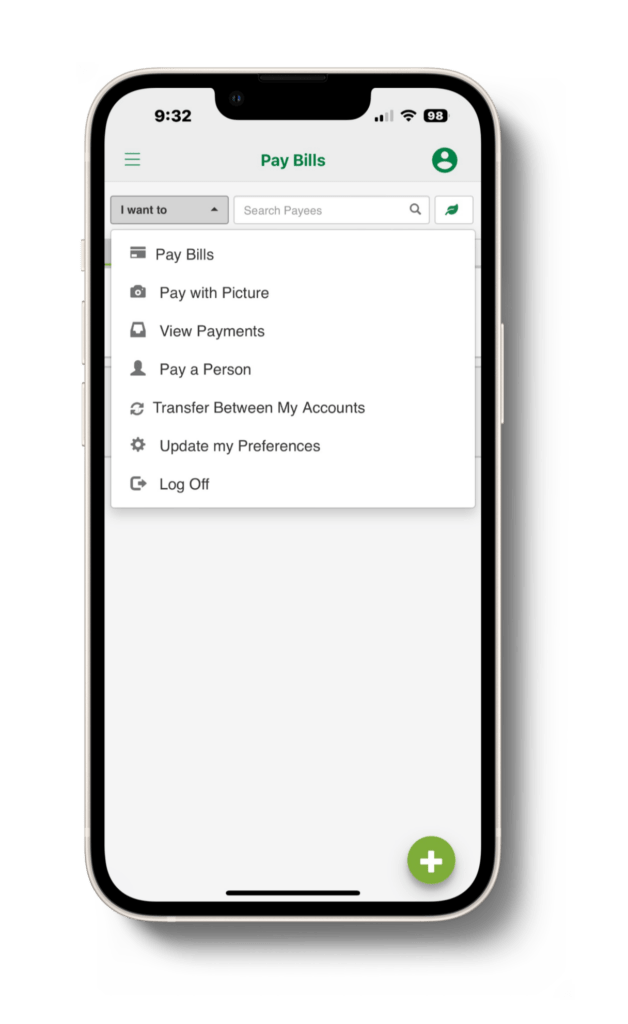

Transfer Money

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.