Justin Calheno

LUDLOW

VICE PRESIDENT, BUSINESS DEVELOPMENT OFFICER, RETAIL LENDING

NMLS #5549

jcalheno@countrybank.com

Direct Dial: 413-277-2370

Cell: 413-626-0395

Save $750 on your mortgage closing costs with our Community Heroes Program if you open or have an existing Country Bank checking account with e-Statements and Automatic payment of your mortgage from your Country Bank checking account.

Teachers

Firefighters

Law Enforcement

Emergency Medical Technicians (EMTs)

Paramedics

Active or Former Military

Medical Care Providers

Discover if you are eligible for our Community Heroes program. Here’s what you’ll need to qualify:

Contact one of our Mortgage experts to see if you qualify.

| Product | Interest Rate | Points | Caps* | Annual Percentage Rate | Monthly Payment Per $1,000 |

|---|---|---|---|---|---|

| 10/1 ARM (30 Year) | 5.875% | 0 | 2% / 4% | 6.066% | $5.92 first ten years (120 payments). $6.09 after initial adjustment (240 payments)** |

All Annual Percentage Rates (APR) listed assume a $320,000.00 mortgage and a 20% down payment unless otherwise stated. Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Rates May Increase After Consummation. Mortgage payments per $1,000 based on 30-year amortization. Payment based on fully indexed rate for next adjustment period.

*CAP Structure: Initial Adjustment/Lifetime Adjustment. The margin on all Adjustable Rate mortgages is 2.750% unless otherwise noted.

Disclaimer: This calculator is for informational purposes only and its use does not guarantee an extension of credit. Your actual term and payment will be provided upon acceptance of a Country Bank Loan.

When you’re applying for a mortgage, it’s important to have someone you trust at your side. We’re experts at walking you through the entire process, answering your questions, and cheering you on to success. It’s what we’re made to do.

LUDLOW

VICE PRESIDENT, BUSINESS DEVELOPMENT OFFICER, RETAIL LENDING

NMLS #5549

jcalheno@countrybank.com

Direct Dial: 413-277-2370

Cell: 413-626-0395

SPRINGFIELD & SURROUNDING AREAS

AVP, MORTGAGE & COMMUNITY DEVELOPMENT OFFICER

NMLS #689658

lsanchez@countrybank.com

Direct Dial: 413-277-2041

Cell: 413-209-4823

Bilingual

Servicio en Español

CHARLTON, PAXTON, WEST BROOKFIELD & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #1687192

sdesantis@countrybank.com

Direct Dial: 413-277-2114

Cell: 413-302-3467

HOLDEN, SHREWSBURY, WESTBOROUGH & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #1650773

dgentleman@countrybank.com

Direct Dial: 413-277-2058

Cell: 774-502-7578

LEICESTER, WORCESTER & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #432698

kkemp@countrybank.com

Direct Dial: 413-277-2383

Cell: 774-200-5017

BELCHERTOWN, LONGMEADOW & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #432695

jsoucia@countrybank.com

Direct Dial: 413-277-2348

Cell: 413-262-2141

BRIMFIELD, PALMER, WARE & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #618959

jvelez@countrybank.com

Direct Dial: 413-277-2318

Cell: 413-636-2925

Take control of your future finances and set yourself up for success by making informed mortgage choices today.

We have you covered! Here is the information you’ll need when you are ready to apply for a mortgage.

STEP 1: GET PRE-QUALIFIED TO MAKE YOUR PURCHASE

Fill out a mortgage application for a prequalification. As part of this process we will obtain your credit report and request income documentation. We will then determine the amount you would be approved for and issue a prequalification letter. This letter can be used to put in an offer on a home.

STEP 2: APPLYING FOR YOUR MORTGAGE LOAN

If you are purchasing a property, you will want to contact your loan officer to get your mortgage application started and submitted once an offer is accepted. If you already own the property than simply reach out to a loan officer to get the mortgage application started and submitted.

STEP 3: REVIEW LOAN ESTIMATE

Once we have received and processed your submitted mortgage application, you will receive your initial loan disclosure paperwork which includes your loan estimate which includes a breakdown of potential closing costs and an estimated sum of necessary funds needed to complete your transaction.

STEP 4: PROPERTY APPRAISAL

Once you have reviewed your initial disclosure package and signed your intent to proceed. The appraisal fee will be collected and your appraisal will be ordered. The property will be appraised to establish its current market value.

STEP 5: UNDERWRITING PROCESS

The Loan Processor will submit your paperwork to a Residential Mortgage Underwriter who will underwrite this file to secondary market guidelines.

STEP 6: LOAN APPROVAL PACKAGE

After underwriting has approved your mortgage, the loan approval package will be sent out to you. Typically, this package will contain any outstanding loan conditions that are needed before the closing can be scheduled with the attorney. Once underwriting has received and reviewed the outstanding conditions, the loan will be cleared to close. At that point you will begin to work on scheduling the closing with your attorney. At least three days before your closing, you will receive your initial closing disclosure. This is a very important document as it breaks down the amount needed to bring to the closing.

STEP 7: CLOSING

The “closing” is the last step in buying and financing a home. This is when you and all the other parties in a mortgage loan transaction sign the necessary documents. Before you sign, make sure you carefully read and understand all the loan documents.

Closing costs are the fees you pay to complete your loan; they include but are not limited to origination fee, title insurance, prepaid escrows, and more. Closing costs will vary depending on many different factors including the loan program applied for, down payment, etc. Your loan officer will provide you with a loan estimate that will break down expected closing costs.

Disclosures

** Maximum financing is based on sales price or appraised value, whichever is less. Additional Disclosures: Loan Product Available for Community Heroes that will be purchasing a property or are currently employed in Country Bank’s Assessment Area. $750 closing cost credit is only valid on Community Heroes Program applications received, approved and closed with Country Bank. All loan applications subject to credit underwriting and property approval (subject to change at any time). The incentive will be applied as a Lender Credit on the Closing Disclosure at time of closing if you open or have an existing Country Bank checking account, along with the two following services: e-Statements and Automatic payment of your mortgage from your Country Bank checking account. Other fees may apply. All accounts and services must be established within twenty (20) days from the date of application or the incentive to receive the credit is null and void. All accounts and services are subject to individual approval. Cannot be combined with any other offer. Only one (1) coupon per mortgage application allowed. This offer can be withdrawn at any time.

Experience the difference of exceptional service when you stop by a local banking center.

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.

Manage your accounts from the palm of your hand whenever it’s convenient for you.

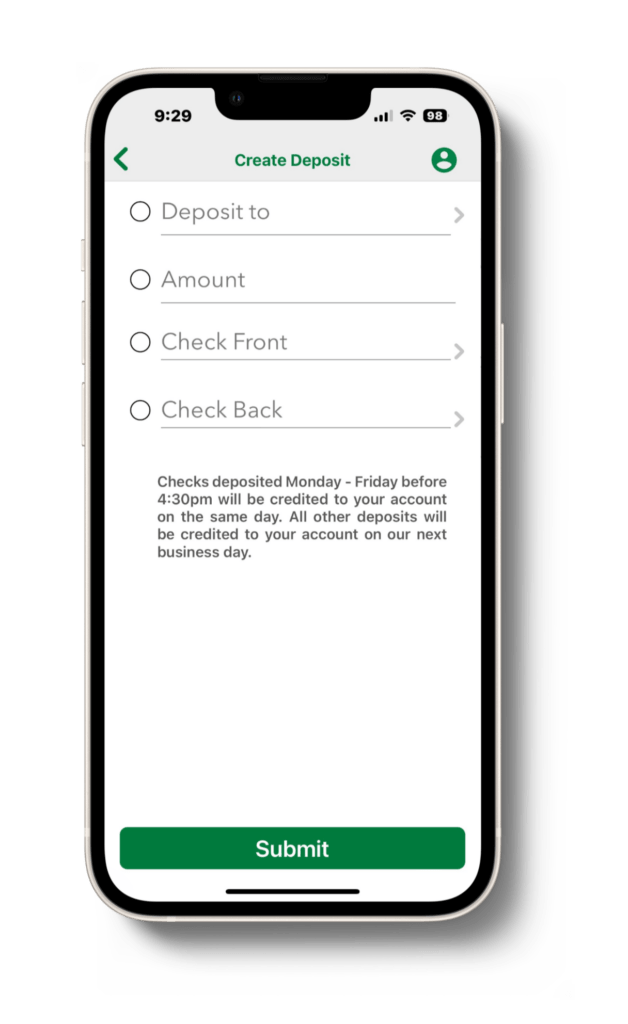

Deposit checks with the snap of a photo.

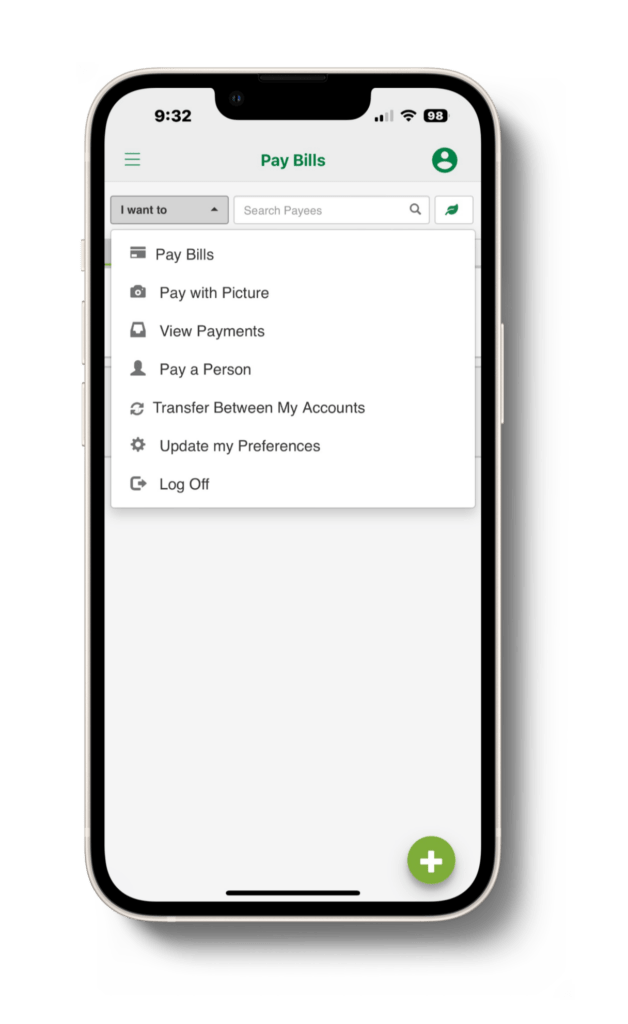

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.