Black History Month

The history of banking in the United States has been shaped by individuals and institutions that expanded access, opportunity, and trust within the financial system. For Black communities, progress often came through resilience, leadership, and innovation in the face of exclusion. The stories below highlight early foundations, groundbreaking leadership, and lasting impact, reminding us how knowledge, representation, and access continue to influence financial well being today.

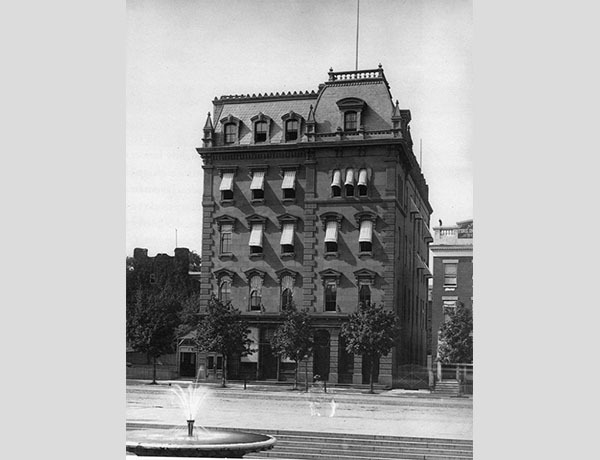

Freedman’s Savings Bank

Founded in 1865, Freedman’s Savings Bank was created to serve formerly enslaved Black Americans and Black Union soldiers after the Civil War. At a time when most financial institutions excluded Black communities, the bank encouraged saving, economic stability, and independence. While it ultimately failed due to mismanagement, its legacy laid the foundation for future Black-owned banks and highlighted the critical need for trust and access in banking.

Maggie Lena Walker

In 1903, Maggie Lena Walker made history as the first Black woman to found and lead a bank in the United States. Through St. Luke Penny Savings Bank, she expanded access to savings accounts, homeownership, and financial opportunity for Black families. Her leadership demonstrated how banking could be a powerful tool for community empowerment and economic progress.

Andrew F. Brimmer

Appointed in 1966, Andrew F. Brimmer became the first Black Governor of the Federal Reserve Board. As an economist and policymaker, he helped shape national monetary policy while emphasizing the real-world impact of economic decisions on employment and underserved communities. His work marked a major step toward representation at the highest levels of U.S. banking leadership.

Closing the Wealth gap through Knowledge

Education and access to financial knowledge have long been recognized as powerful tools for economic opportunity and long term stability. Throughout history, Black educators and economists have emphasized the role knowledge plays in creating independence, confidence, and progress. The voices below reflect that enduring truth.

John Hope Bryant

“Financial literacy is civil rights for the 21st century.”

As the founder of Operation HOPE, John Hope Bryant has spent decades advancing financial education as a pathway to economic empowerment. His work reinforces the idea that understanding money is essential to building opportunity and closing the wealth gap.

Sadie Tanner Mossell Alexander

“Education is the key to unlock the golden door of freedom.”

The first Black woman to earn a PhD in economics, Sadie Tanner Mossell Alexander believed education was foundational to economic mobility. Her legacy continues to connect learning with access, opportunity, and justice.

Carter G. Woodson

“The real purpose of education is to enable one to use knowledge.”

Known as the founder of Black History Month, Carter G. Woodson emphasized the importance of education not just as information, but as a tool for action and progress. His work reminds us that knowledge gains value when it is applied to create opportunity.

The legacy of Black leaders, educators, and advocates reminds us that progress is built through access to knowledge, opportunity, and representation. From shaping the foundations of banking to advancing financial education and economic empowerment, their contributions continue to influence how institutions serve and support communities today. By honoring this history and investing in financial knowledge, we can help foster confidence, stability, and a more inclusive financial future for generations to come.

See More

Related Posts

Most Valuable Teachers

Business Spotlight: Guided Growth Therapy Collective

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

Contact Us

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.