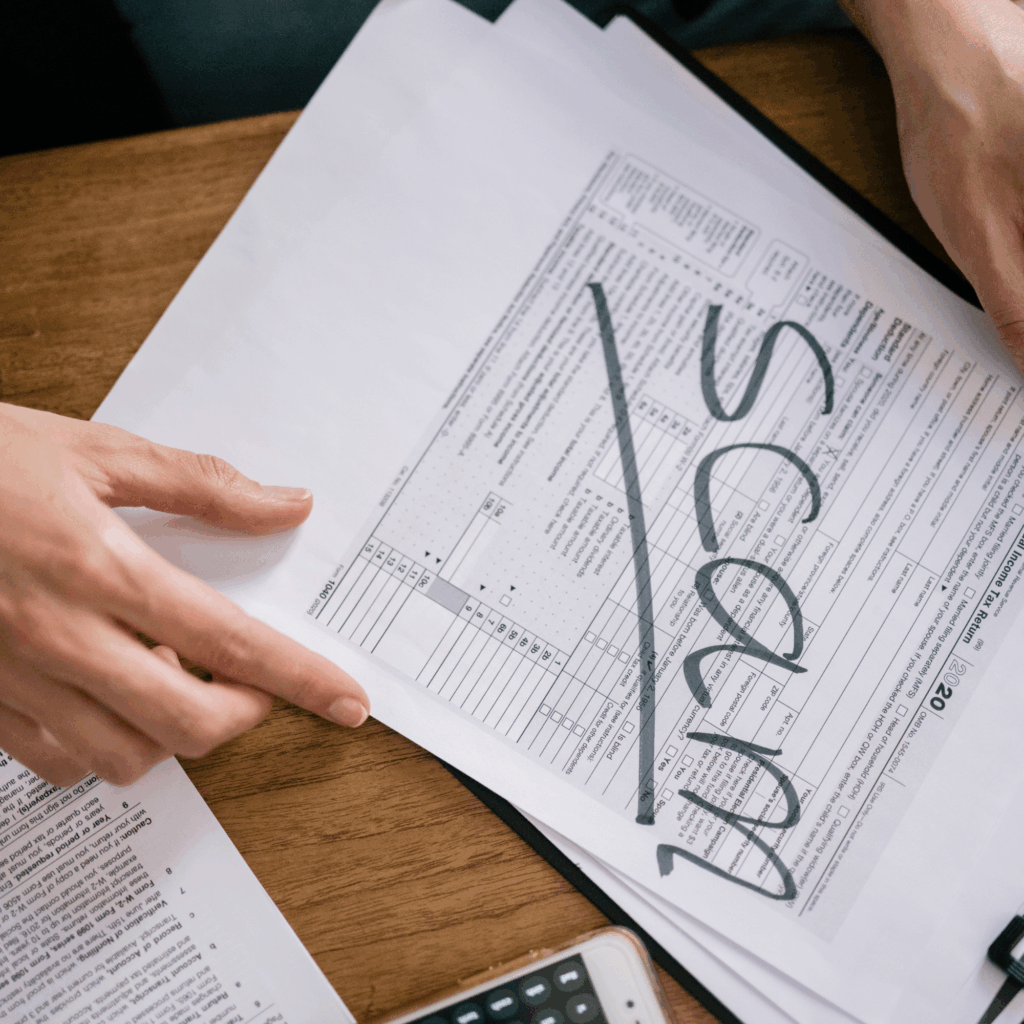

PROTECT YOUR ASSETS

FRAUD PREVENTION STARTS HERE

Please remember, Country Bank will never call, text or email you to ask for your Personal Identification Number (PIN), online banking credentials, debit card number or to confirm a payment. If you receive a suspicious request from someone claiming to be from the bank, do not share any information. Hang up and call our Customer Care Center directly at 800-322-8233 so we can help!

Red Flags to Spot the Scams

Deceptive Messages

- Look for urgent or threatening language.

- Watch for spelling and grammatical mistakes.

- Never trust links or attachments you didn’t ask for.

Imposter Scams

- Be wary of anyone demanding payment in gift cards or wire transfers.

- Remember, Country Bank and government agencies like the IRS will never call you to ask for confidential information.

- Hang up if you feel pressured. Call back using an official number or call us instead.

Payment App Fraud

- Only send money to people you know and trust.

- Treat a payment app like cash—transactions are often instant and irreversible.

- Beware of “accidental” payments from strangers who ask you to send money back.

Awareness is Key

Check out these tips!

- Monitor and report suspicious activity! Ongoing monitoring and timely reporting of suspicious activity are crucial to deterring or recovering from these frauds. Report log-ins at unusual times of day, new user accounts, unauthorized transfers, etc., so the Bank can immediately block the account and monitor activity.

- Be wary of distractions designed to camouflage a takeover: Robo-calls flooding your phone lines or an email “dump” flooding your inbox – both are designed to hide any automatic alerts or phone calls from the Bank.

- Country Bank will never ask you for any personal or identifying information through an email link.

- Only use the address that you have used before or start at your normal homepage, NEVER through a link.

- Look for the lock at the bottom of your browser and “https” in front of the website address.

- Take note of the header address on the website. Most legitimate sites will have a relatively short internet address that usually depicts the business followed by .com, .NET or .org. Spoof sites are more likely to have an excessively long string of characters.

- If you have any doubts about an email or website, contact the legitimate company directly. Make a copy of the questionable website’s URL address, send it to the legitimate business and ask if the address is legitimate.

- When creating your passwords, don’t use information that could easily be linked to you (i.e. phone number, your date of birth).

- Do not share your passwords or PINs with anyone or store them where they can be found.

CORPORATE ACCOUNT TAKEOVER

Corporate Account Takeover is a type of business identity theft in which a criminal entity steals a business’s valid online banking credentials. Small to mid-sized businesses remain the primary target of criminals, but any business can fall victim to these crimes. Attacks today are typically perpetrated quietly by the introduction of malware through a simple email or infected website.

What is the risk?

The Bank’s ability to protect you is severely undermined when your online credentials are compromised by a data breach initiated within your computer system. Once your computer is compromised, any action you can take from your online banking, a criminal will attempt to do fraudulently. For example: Bill Pay, ACH Transfers, Wires, copies of checks and signatures, etc. Any possible way to financially defraud you will not be overlooked by smart criminals with the intent to steal your money or personal information.

How does it happen?

Hackers often take aim at small business’ computers because they are easier to infiltrate than banks’ systems.

Examples:

- An infected document attached to an email

- A link within an email that connects to an infected website

- Employees visiting legitimate websites (especially social networking sites) and clicking on the infected documents, videos, or photos posted there

- An employee using a flash drive that was infected by another computer

Once the employee opens the attachment or goes to the website, malware is installed on the computer. In each case, fraudsters exploit the infected system to obtain security credentials that they can use to access a company’s business accounts. Once embedded, it can even seek out others within the network to gain secondary access or credentials. While up-to-date antivirus software offers substantial protection against malware, it isn’t 100% effective. According to the FBI, there is no single deterrent that is 100% effective against fraud, viruses, and malware.

Protect Your Account

- Use Strong, Unique Passwords. Combine letters, numbers, and symbols. Avoid using the same password for multiple sites.

- Turn on Multi-Factor Authentication (MFA). This is one of the strongest layers of security you can add to your account. It requires a second code (usually sent to your phone) to log in.

- Set Up Account Alerts. Get instant email or text notifications for transactions, logins, or low balances. This lets you spot unusual activity right away.

PREVENT IDENTITY THEFT WITH KASASA PROTECT™

Within minutes you can receive:

- 24/7 Credit Monitoring

- Credit Reporting

- Credit Score & Tracking

- Dark Web Monitoring

- Lost Wallet Protection

- Identity Restoration

Report a Problem

- Review Your Account. Log in to your online banking and carefully check your recent transactions and activity.

- Take action and call us immediately.

- Consider a Fraud Alert. You can place a free, 1-year fraud alert on your credit report by contacting one of the three national credit bureaus.

Is something wrong?

Debit Card Dispute FAQs

How do I file a debit card dispute?

Only posted transactions may be disputed.

During normal business hours:

- Call our Customer Care Center at 800-322-8233,

- Visit one of our Banking Center locations, or

- Send us a ‘Secure Message’ through your online banking profile

After normal business hours, please notify our Debit Card Dispute partner (around-the-clock service) at 866-279-1399.

What is a pending transaction?

A pending transaction occurs when you initiate a purchase, but the merchant has not yet finalized the transaction.

Pending transactions vs. posted transactions: What’s the difference?

The primary difference between a pending transaction and a posted transaction lies in their status:

- Pending transaction: A temporary hold placed on your account that has not yet been finalized. It reflects the authorization of the charge but not the actual completion.

- Posted transaction: A finalized transaction that has been processed by the merchant and your bank. It officially appears in your account history, and the funds or credit have been permanently adjusted.

Pending transactions can change (i.e. cancellation or alteration in amount), while posted transactions are permanent and reflect the final amount charged.

Does a pending transaction mean it went through?

Not necessarily. A pending transaction means that the merchant has authorized the charge but hasn’t completed it. In some cases, pending transactions may not go through if the merchant cancels the order, fails to finalize the payment, or adjusts the amount. Until the final transaction is posted, it’s possible that the charge could change or even disappear.

Do pending transactions still take money out?

Pending transactions don’t officially withdraw money from your account, but they affect your available balance. The funds associated with the pending charge are “reserved,” so they aren’t available for other transactions. Once the transaction is posted, the amount is fully deducted from your account.

How long do pending transactions take?

Typically, pending transactions take one to three business days to process. This timeframe varies depending on the type of transaction and the merchant’s processing times.

For example, debit card transactions at a retail store may post the next day, while hotel and car rental holds may take a few days to clear — particularly if there’s a delay in finalizing the amount due.

Keep Your Money Safe

Read More Fraud Prevention Tips

Crypto Scams: When “Easy Returns” Sweep Your Money Away

Deepfakes & Voice Cloning: How to Spot AI Imposter Scams Before They Cost You

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

Contact Us

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.