Locations

Experience the difference of exceptional service when you stop by a local banking center.

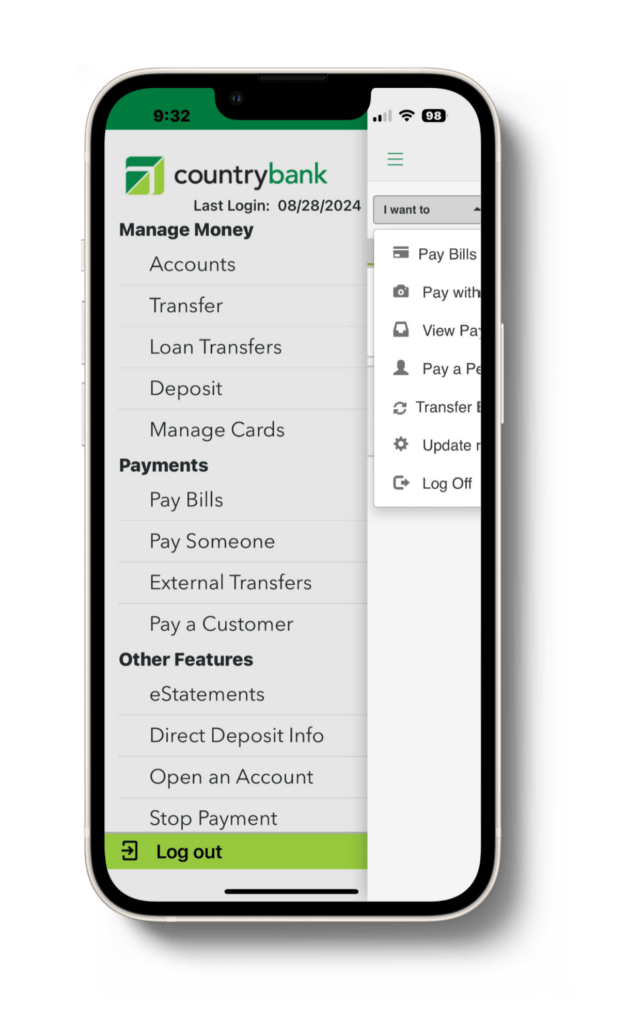

Follow these simple directions to temporarily turn your card off.

If you believe that your card has been lost or stolen, notify us immediately by calling 800-322-8233 during normal business hours or 833-933-1681 during non-business hours.

Please call 812-647-9794.

Once you report your debit card as stolen, you can visit any of our banking centers to receive a replacement card instantly!

Visit a location near you and speak to one of our team members during normal business hours.

No need to panic! If you notice suspicious activity on your bank statements or within your account transactions, please let us know as soon as possible.

Notify our Debit Disputes partner immediately by calling 866-279-1399 (available 24/7) or contact us at 800-322-8233 during normal business hours.

Only posted transactions may be disputed.

During normal business hours:

After normal business hours, please notify our Debit Card Dispute partner (around-the-clock service) at 866-279-1399.

A pending transaction occurs when you initiate a purchase, but the merchant has not yet finalized the transaction.

The primary difference between a pending transaction and a posted transaction lies in their status:

Pending transactions can change (i.e. cancellation or alteration in amount), while posted transactions are permanent and reflect the final amount charged.

Not necessarily. A pending transaction means that the merchant has authorized the charge but hasn’t completed it. In some cases, pending transactions may not go through if the merchant cancels the order, fails to finalize the payment, or adjusts the amount. Until the final transaction is posted, it’s possible that the charge could change or even disappear.

Pending transactions don’t officially withdraw money from your account, but they affect your available balance. The funds associated with the pending charge are “reserved,” so they aren’t available for other transactions. Once the transaction is posted, the amount is fully deducted from your account.

Typically, pending transactions take one to three business days to process. This timeframe varies depending on the type of transaction and the merchant’s processing times.

For example, debit card transactions at a retail store may post the next day, while hotel and car rental holds may take a few days to clear — particularly if there’s a delay in finalizing the amount due.

Experience the difference of exceptional service when you stop by a local banking center.

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.

Select “Manage Cards” from the menu.

If you think you temporarily lost your card, you can turn your card off and on as you need.