THE RIGHT MORTGAGE MAKES ALL THE DIFFERENCE

MORTGAGE OPTIONS

ADJUSTABLE RATE MORTGAGE

REFINANCE

MOBILE HOME LOANS

FIRST TIME HOME BUYER

Learn MoreCONSTRUCTION LOAN

Learn MoreLAND LOANS

Learn MoreLOWER RATES THAT ARE MADE TO MAKE A DIFFERENCE

MORTGAGE RATES

Looking for a smart investment? Our low mortgage rates and refinance rates mean more savings for you! Whether you’re buying your first home, second home, investment properties or refinancing, now is the perfect time to lock in a great rate.

Rate Effective Date: February 23, 2026

| Product | Interest Rate | Points | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 30 Year | 6.000% | 0 | 6.062% | $6.00 |

| 5.625% | 1 | 5.744% | $5.76 | |

| 5.375% | 2 | 5.549% | $5.60 | |

| 20 Year | 5.625% | 0 | 5.707% | $6.95 |

| 5.375% | 1 | 5.533% | $6.81 | |

| 5.125% | 2 | 5.358% | $6.67 | |

| 15 Year | 5.500% | 0 | 5.603% | $8.17 |

| 5.125% | 1 | 5.323% | $7.97 | |

| 4.750% | 2 | 5.042% | $7.78 | |

| 10 Year | 5.500% | 0 | 5.646% | $10.85 |

| 4.875% | 1 | 5.156% | $10.55 | |

| 4.625% | 2 | 5.043% | $10.42 |

Owner-Occupied Construction Mortgage financing is based on a single closing construction-to-permanent basis.

All Annual Percentage Rates (APR) listed assume a $320,000.00 mortgage and a 20% down payment unless otherwise stated. Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Mobile Homes with own land will be financed as a 15 Year (180 months) amortization

| PRODUCT | INTEREST RATE | Points | CAPS* | ANNUAL PERCENTAGE RATE | MONTHLY PAYMENT PER $1,000 |

|---|---|---|---|---|---|

| 5/3 ARM (30 year) | 5.375% | 0 | 2% / 4% | 5.896% | $5.60 first five years (60 payments), $6.02 after initial adjustment (300 payments)** |

| 7/3 ARM (30 year) | 5.500% | 0 | 2% / 4% | 5.870% | $5.68 first seven years (84 payments), $6.01after initial adjustment (276 payments)** |

| 10/1 ARM (30 year) | 6.000% | 0 | 2% / 4% | 6.105% | $6.00 first ten years (120 payments), $6.05 after initial adjustment (240 payments)** |

Owner-Occupied Construction Mortgage financing is based on a single closing construction-to-permanent basis. The initial interest rate may be discounted until the first review period. The annual percentage rate is subject to increase or decrease after closing.

All Annual Percentage Rates (APR) listed assume a $320,000.00 mortgage and a 20% down payment unless otherwise stated. Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Mobile Homes with own land will be financed as a 15 Year (180 months) amortization.

Rates May Increase After Consummation. Mortgage payments per $1,000 based on 30-year amortization.

*CAP Structure: Initial Adjustment/Lifetime Adjustment. The margin on all Adjustable Rate mortgages is 2.750% unless otherwise noted.

**Payment based on fully indexed rate for next adjustment period.

| Product | Interest Rate | Points | CAPS | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|---|

| 10/1 ARM First Time Home Buyer (30 Year) | 5.750% | 0 | 1% / 4% | 5.767% | $5.84 |

| 30 Year Fixed First Time Home Buyer | 5.990% | 0 | N/A | 6.052% | $5.99 |

| Low Down Payment First Time Homebuyer 10/1 ARM (30 Year)** | 5.750% | 0 | 1% / 4% | 5.767% | $5.84 |

| 30 Year Fixed Low Down Payment First Time Homebuyer** | 5.875% | 0 | N/A | 5.937% | $5.92 |

All Annual Percentage Rates (APR) listed assume a $320,000.00 mortgage and a 20% down payment unless otherwise stated. Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

**Lender-paid Private Mortgage Insurance (PMI); Income and Property Location Restrictions Apply.

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval.

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Mobile Homes with own land will be financed as a 15 Year (180 months) amortization.

For all Adjustable Rate Mortgages (ARM), the Rates May Increase After Consummation. Mortgage payments per $1,000 based on 30-year amortization. The margin on all Adjustable Rate First Time Home Buyer mortgages (ARM) is 2.250%, unless otherwise noted.

Home Possible

| Product | Interest Rate | Points | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 30 year | 6.000% | 0 | 6.657% | $6.00 |

Annual Percentage Rate (APR) based on $320,000.00 loan with Private Mortgage Insurance (PMI)

All loan applications are subject to credit approval.

Rates, APRs, and margins are subject to change based on factors such as points, loan amounts, loan-to-value, credit history, property type, and occupancy.

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Owner-Occupied Construction Mortgage financing is based on a single closing construction-to-permanent basis. The rates and terms are the same as Owner-Occupied Fixed and Adjustable Rate products.

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Mobile Homes with own land will be financed as a 15 Year (180 months) amortization.

Home One

| Product | Interest Rate | Points | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 30 year | 6.000% | 0 | 6.531% | $6.00 |

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All Loans Subject to Credit Approval.

Country Bank will lock in the interest rate for sixty (60) calendar days from the date of the receipt of the loan application.

Annual Percentage Rate (APR) based on $320,000.00 loan with Private Mortgage Insurance (PMI)

| PRODUCT | INTEREST RATE | CAPS | ANNUAL PERCENTAGE RATE | MONTHLY PAYMENT PER $1,000 – PAYMENTS 1-36 | MONTHLY PAYMENT PER $1,000 – PAYMENTS 37-180 |

|---|---|---|---|---|---|

| Building Lot (15 Year) Product: 3/1 ARM 20% down is required Margin 4.000% | 7.250% | 2% / 6% | 7.431% | $9.13 | $9.19 |

| PRODUCT | INTEREST RATE | CAPS | ANNUAL PERCENTAGE RATE | MONTHLY PAYMENT PER $1,000 – PAYMENTS 1-36 | MONTHLY PAYMENT PER $1,000 – PAYMENTS 37-120 |

| Raw Land (10 Year) Product: 3/1 ARM 40% down is required Margin 5.000% | 8.250% | 2% / 6% | 8.460% | $12.27 | $12.31 |

Annual Percentage Rate (APR) based on guarantee fee of 1.00% and annual fee of 0.35%

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval.

Interest Rate Lock for 75 days upon receipt of signed intent to proceed and applicable application fee.

Annual Percentage Rate (APR) based on guarantee fee of 1.00% and annual fee of 0.35%

| Product | Interest Rate | Points | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 30 year | 6.000% | 0 | 6.531% | $6.00 |

All Annual Percentage Rates (APR) listed assume a $320,000.00 mortgage and a 20% down payment unless otherwise stated.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payment based on fully indexed rate for next adjustment period.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval.

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

CAPS: Initial Adjustment/Lifetime Adjustments.

| Product | Interest Rate | Points | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 30 year | 6.000% | 0 | 6.531% | $6.00 |

Annual Percentage Rate (APR) based on $320,000.00 loan with Private Mortgage Insurance (PMI)

All loan applications are subject to credit approval.

Rates, APRs, and margins are subject to change based on factors such as points, loan amounts, loan-to-value, credit history, property type, and occupancy.

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Owner-Occupied Construction Mortgage financing is based on a single closing construction-to-permanent basis. The rates and terms are the same as Owner-Occupied Fixed and Adjustable Rate products.

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing).

Mobile Homes with own land will be financed as a 15 Year (180 months) amortization.

NAVIGATE YOUR MORTGAGE OPTIONS WITH CONFIDENCE

Custom Solutions

When it comes to buying a home, one size does not fit all. Your homeownership dream will look different than your neighbors, and that’s ok! That’s why we offer a variety of home loan options and terms to choose from.

Professional Expertise

Count on Country Bank’s experienced mortgage professionals to help you meet your financial needs!

Local Decisions

Whether you live near any of our Massachusetts Banking Center cities or towns, you can be certain you’ll receive trustworthy service and fast local mortgage approvals.

This calculator is for informational purposes only and its use does not guarantee an extension of credit. Your actual term and payment will be provided upon acceptance of a Country Bank Loan.

PREQUALIFY FOR YOUR MORTGAGE AND SAVE

A prequalification will help you:

- Know what you can afford to help narrow down your shopping.

- Show sellers you’re serious and strengthen your offer.

- Speed up your mortgage approval so you can close faster and move into your home sooner.

- Possibly identify any financial issues early so you can address them and move on.

ADJUSTABLE RATE MORTGAGE VS FIXED RATE MORTGAGE

Adjustable Rate Mortgage

An adjustable-rate mortgage (ARM) is a home loan with an interest rate that changes after an initial fixed-rate period, usually three to ten years. This initial period offers a discounted rate before adjustments are made based on market conditions. ARMs often include caps to limit rate fluctuations so you know what to expect.

Fixed Rate Mortgage

If you value predictable mortgage payments and plan to stay in your home for the long haul, a fixed rate mortgage may be the perfect solution for your unique financial situation. Gain financial certainty knowing your exact mortgage payment and the date you’ll make your last mortgage payment.

BUNDLE TO GET MORE

Mortgage Bonus Bundle Program

With bundled benefits and a bank that really cares, your mortgage means more. Enjoy additional perks when you bundle your Mortgage, Checking and Savings Accounts with Country Bank!

SHOULD I REFINANCE MY MORTGAGE?

Refinance Tips:

There’s a lot to consider when it comes to deciding if now is the right time to refinance your mortgage. Dive into these factors to see how (and if) refinancing can make a difference:

- Compare Interest Rates: If the current rates are significantly lower than what you’re paying, refinancing might be a great solution, potentially saving you money on interest over the life of the mortgage.

- Consider Your Financial Goals: Refinancing may help you achieve financial goals, such as lowering your monthly payments, shortening the loan term, or tapping into home equity for other purposes.

- Calculate The Break-Even Point: Determine if refinancing makes financial sense by calculating how long it will take to recoup closing costs through monthly savings. If you plan to stay in the home beyond this point, refinancing may be worthwhile; otherwise, it might not be cost-effective.

Not sure if refinancing is right for you? Contact one of our mortgage experts today. We are happy to answer any questions you may have.

BUILD YOUR FUTURE

MORTGAGE LOAN PROFESSIONALS

When you’re applying for a mortgage, it’s important to have someone you trust at your side. We’re experts at walking you through the entire process, answering your questions, and cheering you on to success. It’s what we’re made to do.

Justin Calheno

LUDLOW

VICE PRESIDENT, BUSINESS DEVELOPMENT OFFICER, RETAIL LENDING

NMLS #5549

jcalheno@countrybank.com

Direct Dial: 413-277-2370

Cell: 413-626-0395

Lucila (Lucy) Sánchez

SPRINGFIELD & SURROUNDING AREAS

AVP, MORTGAGE & COMMUNITY DEVELOPMENT OFFICER

NMLS #689658

lsanchez@countrybank.com

Direct Dial: 413-277-2041

Cell: 413-209-4823

Bilingual

Servicio en Español

Salema Desantis

CHARLTON, PAXTON, WEST BROOKFIELD & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #1687192

sdesantis@countrybank.com

Direct Dial: 413-277-2114

Cell: 413-302-3467

David Gentleman

HOLDEN, SHREWSBURY, WESTBOROUGH & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #1650773

dgentleman@countrybank.com

Direct Dial: 413-277-2058

Cell: 774-502-7578

Kelly Kemp

LEICESTER, WORCESTER & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #432698

kkemp@countrybank.com

Direct Dial: 413-277-2383

Cell: 774-200-5017

Janelle Soucia

BELCHERTOWN & SURROUNDING AREAS

RETAIL LOAN OFFICER

NMLS #432695

jsoucia@countrybank.com

Direct Dial: 413-277-2348

Cell: 413-262-2141

JoMaria Velez

BRIMFIELD, PALMER, WARE & SURROUNDING TOWNS

RETAIL LOAN OFFICER

NMLS #618959

jvelez@countrybank.com

Direct Dial: 413-277-2318

Cell: 413-636-2925

MORTGAGE DOCUMENTS

FINDING YOUR SOLUTION

MORTGAGE FAQs

What information is needed at the time of the mortgage application?

We have you covered! Here is the information you’ll need when you are ready to apply for a mortgage.

What steps should I expect as part of the mortgage application process?

STEP 1: GET PRE-QUALIFIED TO MAKE YOUR PURCHASE

Fill out a mortgage application for a prequalification. As part of this process we will obtain your credit report and request income documentation. We will then determine the amount you would be approved for and issue a prequalification letter. This letter can be used to put in an offer on a home.

STEP 2: APPLYING FOR YOUR MORTGAGE LOAN

If you are purchasing a property, you will want to contact your loan officer to get your mortgage application started and submitted once an offer is accepted. If you already own the property than simply reach out to a loan officer to get the mortgage application started and submitted.

STEP 3: REVIEW LOAN ESTIMATE

Once we have received and processed your submitted mortgage application, you will receive your initial loan disclosure paperwork which includes your loan estimate which includes a breakdown of potential closing costs and an estimated sum of necessary funds needed to complete your transaction.

STEP 4: PROPERTY APPRAISAL

Once you have reviewed your initial disclosure package and signed your intent to proceed. The appraisal fee will be collected and your appraisal will be ordered. The property will be appraised to establish its current market value.

STEP 5: UNDERWRITING PROCESS

The Loan Processor will submit your paperwork to a Residential Mortgage Underwriter who will underwrite this file to secondary market guidelines.

STEP 6: LOAN APPROVAL PACKAGE

After underwriting has approved your mortgage, the loan approval package will be sent out to you. Typically, this package will contain any outstanding loan conditions that are needed before the closing can be scheduled with the attorney. Once underwriting has received and reviewed the outstanding conditions, the loan will be cleared to close. At that point you will begin to work on scheduling the closing with your attorney. At least three days before your closing, you will receive your initial closing disclosure. This is a very important document as it breaks down the amount needed to bring to the closing.

STEP 7: CLOSING

The “closing” is the last step in buying and financing a home. This is when you and all the other parties in a mortgage loan transaction sign the necessary documents. Before you sign, make sure you carefully read and understand all the loan documents.

Do you have low down payment mortgage options for first time home buyers?

Yes! If you haven’t owned a home in the last three years, we are ready to help you achieve your homeownership goals! Country Bank offers first time home buyer programs and special discounts for first time home buyers.

How much of a down payment do I need?

You can get a conventional mortgage with as little as 3% down. However, if you are financing more than 80% of the lesser of the sales price or value of the home, Private Mortgage Insurance (PMI) is required.

What are the credit requirements to get a mortgage?

Credit requirements are dependent on many different factors, including the loan program applied for. If you are unsure of how your credit history will affect your application, please contact one of our loan officers who will discuss options with you.

What are closing costs, and how much do they cost?

Closing costs are the fees you pay to complete your loan; they include but are not limited to origination fee, title insurance, prepaid escrows, and more. Closing costs will vary depending on many different factors including the loan program applied for, down payment, etc. Your loan officer will provide you with a loan estimate that will break down expected closing costs.

Is a fixed rate mortgage better than an adjustable rate mortgage?

Both fixed rate and adjustable rate mortgages have benefits. It really depends on your particular scenario. Your loan officer will be happy to go over all options with you so you are comfortable with the loan program you have chosen.

Home Equity Lending Staff

Our Home Equity Lending staff is comprised of highly trained professionals at each branch location who will provide you with the best possible service while guiding you through the entire HELOC process. Please contact us today at 800-322-8233 to arrange for an appointment. We look forward to hearing from you!

To comply with the requirements of the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act), Country Bank has registered employees that meet the definition of a Mortgage Originator.

To confirm that your mortgage professional has been registered, visit nmlsconsumeraccess.org and follow the instructions provided. You may also request a listing from branch personnel or by clicking here.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

Contact Us

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.

BANK SMARTER

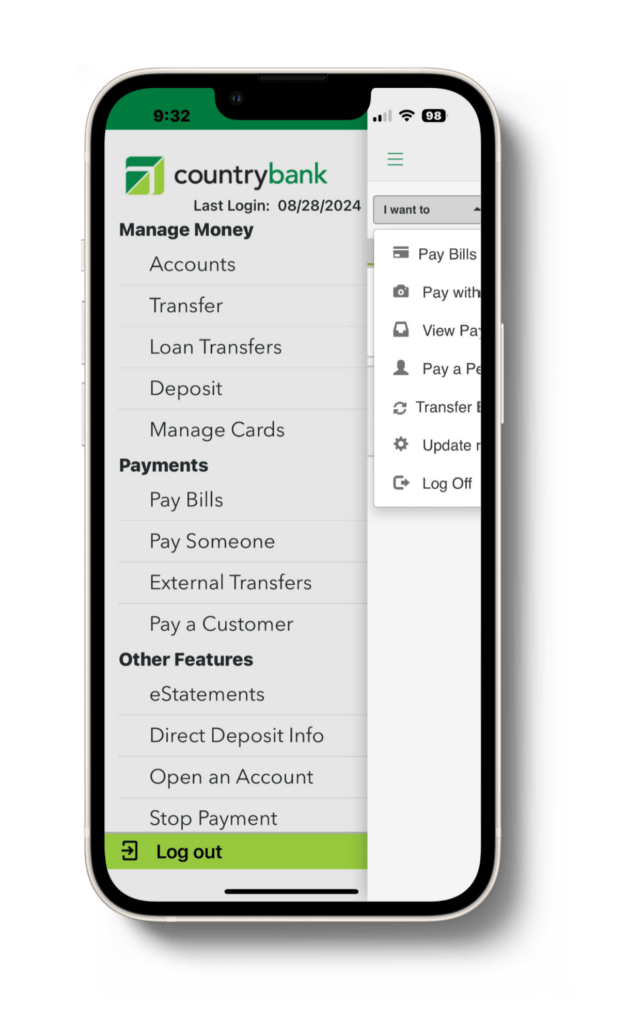

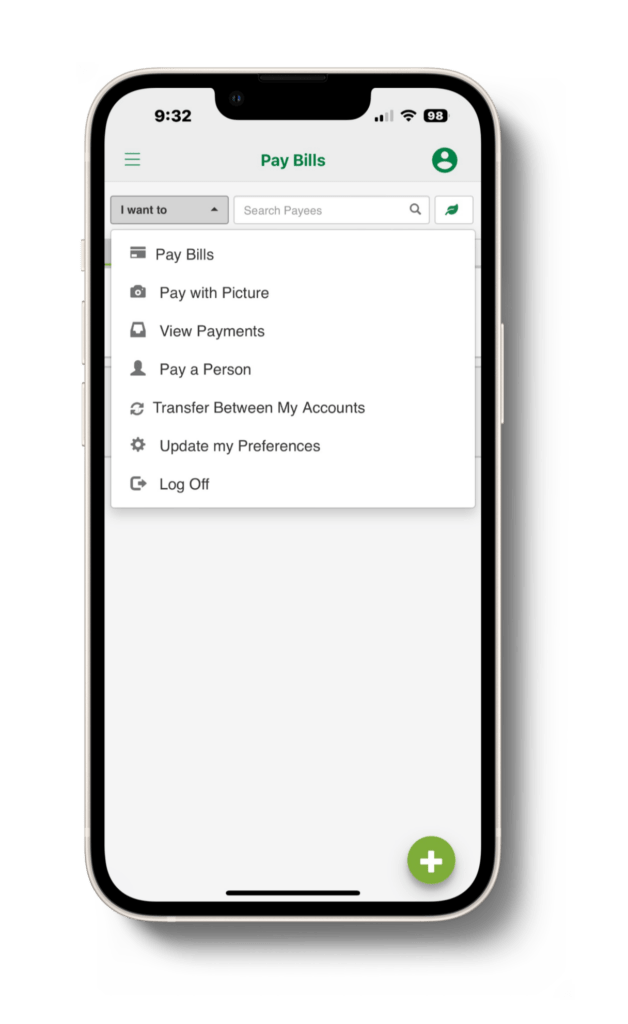

MANAGE YOUR MORTGAGE WITH MOBILE BANKING

View Your Mortgage Balance

Knowing where your current mortgage stands can help you manage refinancing possibilities in the future.

Pay Your Mortgage

In just a few taps, you can pay your mortgage or even set up a recurring payment so you can focus on what matters most.

Make an Additional Mortgage Payment

Make an extra principal-only payment on your mortgage so you can pay your loan off faster.