Secure Purchases

Enjoy enhanced security and protection against debit card fraud with chip card and tap-to-pay technology.

Enjoy enhanced security and protection against debit card fraud with chip card and tap-to-pay technology.

Access thousands of surcharge-free ATMs* through the SUM ATM Network.

Add your debit card to your digital wallet and make purchases with your phone.

Disclosure: *If you choose an ATM outside of the Country Bank or SUM ATM network, a surcharge may be imposed by the machine’s owner. of the Country Bank or SUM ATM network, a surcharge may be imposed by the machine’s owner.

If you believe your debit card has been lost or stolen, notify us immediately by calling 800-322-8233 during normal business hours or 1-833-933-1681 during non-business hours. If you are outside of the U.S. please call 1-812-647-9794 during non-business hours.

Explore the best benefits our card offers:

Give us a call at 800-322-8233 so we can be sure your debit card works as you travel to new states and countries.

Once inside the app, select Secure Messaging. Please include the last four digits of your debit card number, your dates of travel, and your travel locations.

Planning a trip outside the United States? Call our Customer Care Center at 800-322-8233 to ensure seamless access to your account and other services. Safe travels—let us help you stay connected wherever you go!

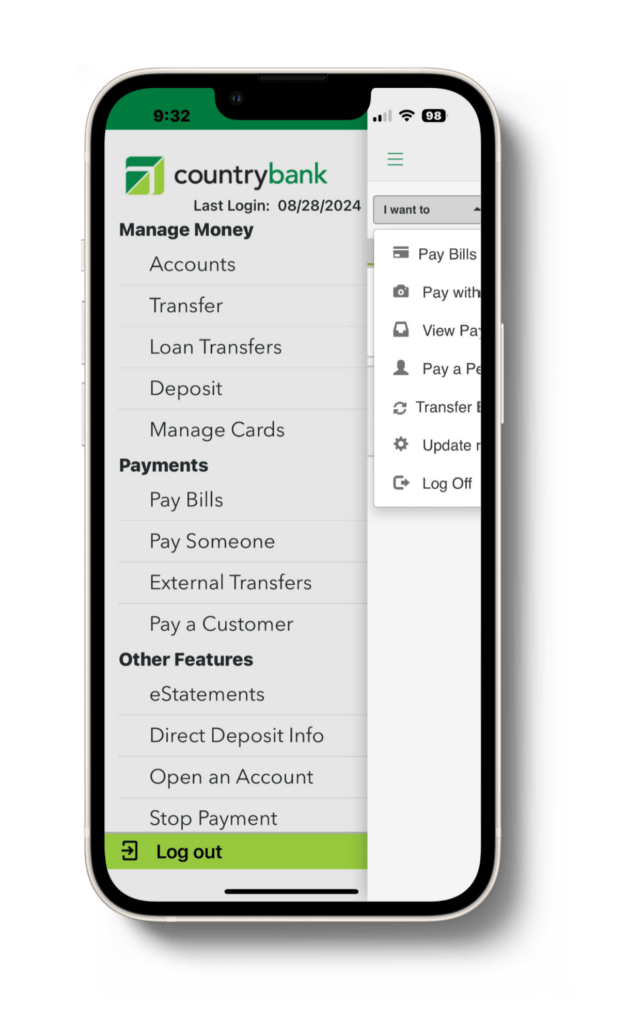

Select “Manage Cards” from the menu.

If you think you temporarily lost your card, you can turn your card off and on as you need.

No. Country Bank does not charge a fee when you use your card; however, you may be subject to a surcharge from another bank when you use their ATM. We belong to the SUM network which allows you to use other SUM member bank’s ATMs without incurring a surcharge. Visit the SUM website for a complete list of participating SUM ATM banks.

Yes, at most of our ATM/ITM locations. The only location that cannot accept deposits is the Worcester Public Market.

The chip is on the front of the card while the magnetic strip is still on the back of the card so you are able to use your card at chip-enabled and magnetic strip terminals.

Each ATM or merchant terminal may be different so the rule of thumb is to “follow the prompts.” You will be prompted to re-insert your chip card after swiping your magnetic strip and most terminals and ATMs require you to leave your card in the terminal until the transaction is complete.

Only posted transactions may be disputed.

During normal business hours:

After normal business hours, please notify our Debit Card Dispute partner (around-the-clock service) at 866-279-1399.

The primary difference between a pending transaction and a posted transaction lies in their status:

Pending transactions can change (i.e. cancellation or alteration in amount), while posted transactions are permanent and reflect the final amount charged.

Not necessarily. A pending transaction means that the merchant has authorized the charge but hasn’t completed it. In some cases, pending transactions may not go through if the merchant cancels the order, fails to finalize the payment, or adjusts the amount. Until the final transaction is posted, it’s possible that the charge could change or even disappear.

Pending transactions don’t officially withdraw money from your account, but they affect your available balance. The funds associated with the pending charge are “reserved,” so they aren’t available for other transactions. Once the transaction is posted, the amount is fully deducted from your account.

Typically, pending transactions take one to three business days to process. This timeframe varies depending on the type of transaction and the merchant’s processing times.

For example, debit card transactions at a retail store may post the next day, while hotel and car rental holds may take a few days to clear — particularly if there’s a delay in finalizing the amount due.

Experience the difference of exceptional service when you stop by a local banking center.

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.