BUSINESS LINE OF CREDIT FEATURES

Competitive Rates

Affordable business line of credit rates mean unlimited business potential.

Flexible Funds

Withdraw only what you need with a business line of credit and only pay interest on what you use.

ADAPT AND GROW WITH A BUSINESS LINE OF CREDIT

Working Capital

Inventory

Seasonal Needs

Equipment Repairs

Expansion

Managing Cash Flow

WHAT IS A BUSINESS LINE OF CREDIT?

Fuel Your Business

A business line of credit is a very flexible borrowing option. It provides access to funds up to a predetermined limit, which you can draw from as needed. Unlike a traditional loan where you receive a lump sum upfront, a line of credit allows you to borrow and repay funds on an ongoing basis. Once repaid, the credit becomes available for future use without needing to reapply.

THE RIGHT BUSINESS LINE OF CREDIT TO MANAGE YOUR BUSINESS

Business Line of Credit

Businesses should stick together! Have confidence funding is available when you need it.

Business Express Line of Credit

Time is money! With a streamlined application process and fast local decisions, you can access up to $25,000 in as few as 3 business days. More Business Express Line of Credit perks include no application fee, no annual fee, and no documentation fee.

HERE’S HOW TO GET A BUSINESS LINE OF CREDIT

Applying Is Simple

As a business owner, we understand how valuable every moment of your day can be. If you are ready to apply for a business line of credit, contact a business banking lender today!

THE DIFFERENCE IS IN THE DETAILS

CASH MANAGEMENT SOLUTIONS FOR YOUR BUSINESS

We strive to make life easier for those who put their blood, sweat, and tears into building something that makes our communities better. Explore these cash management options to save you time and simplify your finances.

BUILDING STRONGER COMMUNITIES, ONE LOAN AT A TIME

BUSINESS LENDING OFFICERS

When done right, a loan can be the difference-maker in helping your business get ahead. You can count on our lenders to customize a solution that serves the unique needs of your business. A loan that’s flexible, allows for higher lending limits, and delivers on the promises made to you. Trust the relationship. Trust the loan.

Shane Elder

FIRST VICE PRESIDENT, BUSINESS BANKING TEAM LEAD COMMERCIAL LOAN OFFICER

selder@countrybank.com

Direct Dial: 413-277-2112

Cell: 508-440-1616

Carla Alves

VICE PRESIDENT, BUSINESS BANKING LOAN OFFICER

calves@countrybank.com

Direct dial: 413-277-2110

Cell: 413-530-7608

Matt Williams

VICE PRESIDENT, BUSINESS BANKING LOAN OFFICER

mwilliams@countrybank.com

Direct Dial: 413-277-2134

EMPOWER YOUR FUTURE

BUSINESS LINE OF CREDIT RESOURCES

As a business owner, it’s crucial to manage your finances wisely to ensure growth and stability. From budgeting effectively to investing in the right areas, every decision counts. Take advantage of these tools and tips to secure your business’s future.

2026 Economic Outlook: Stability, Strength and Smart Growth Ahead!

Country Bank Promotes Senior Leaders in Commercial Banking

Business Spotlight: Ludlow Tennis Club – Building Community Through Sport with Country Bank by Their Side

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

Contact Us

Connect with your local banker by calling 800-322-8233 or sending an email to info@countrybank.com.

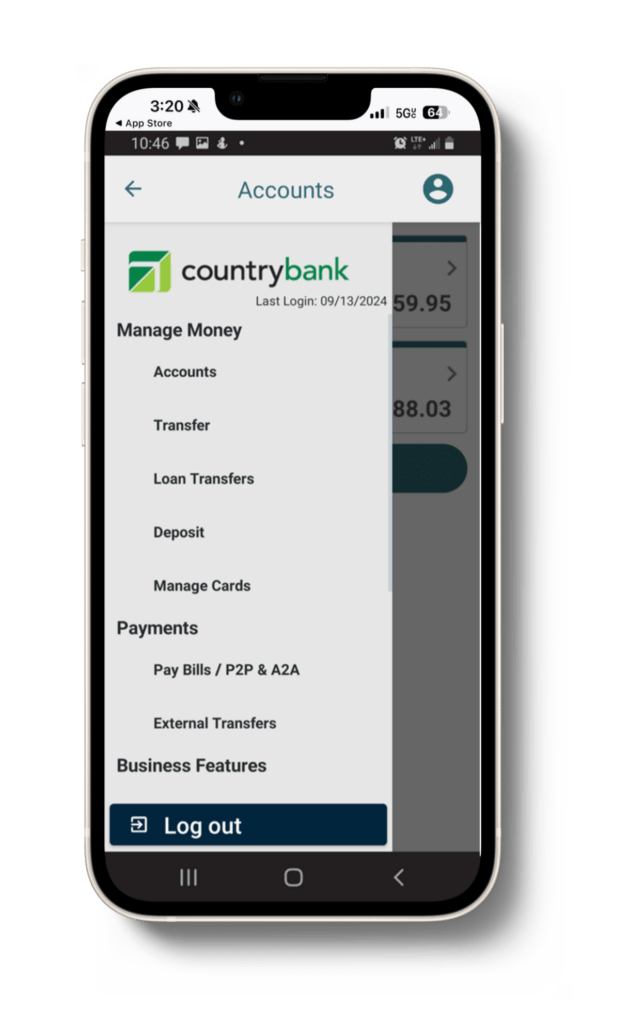

BUSINESS BANKING SIMPLIFIED

MOBILE BANKING

Monitor Your Accounts

Review account balances and transactions for your business checking and business money market accounts.

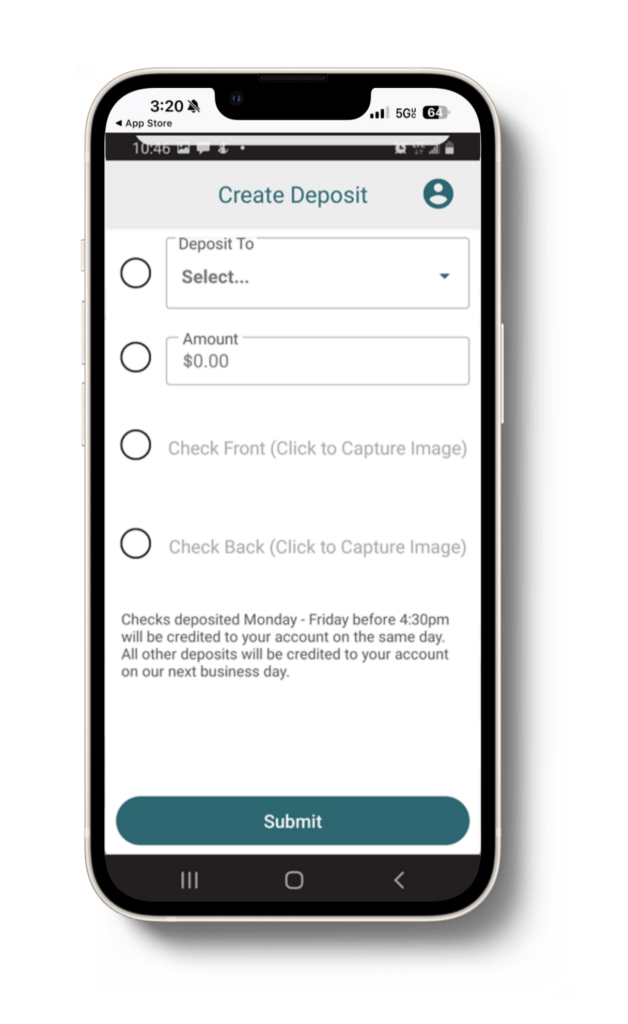

Deposit Checks

Easily deposit your business’s checks from your smartphone 24/7.

Pay Bills

Manage your bills monthly or set recurring payments to stay on top of your business finances.